By David Randall

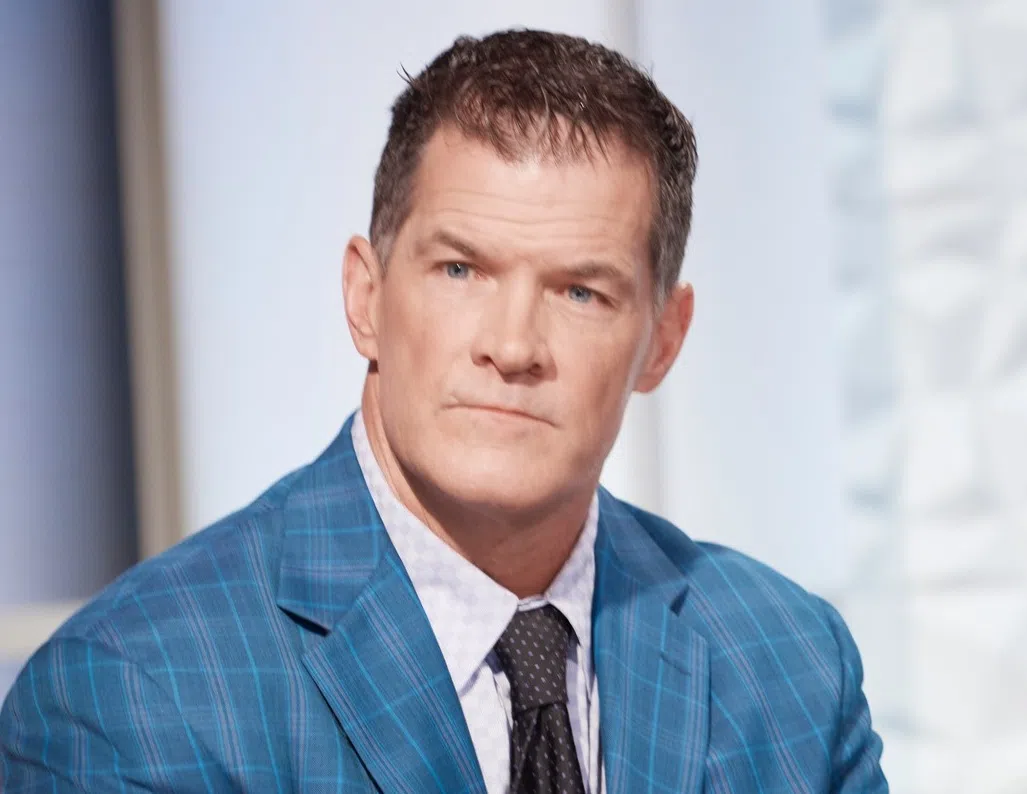

NEW YORK (Reuters) – Meme stock traders will be glued to their screens on Friday, when Keith Gill, online influencer and a key figure behind the eye-popping rally in shares of GameStop in 2021, is expected to host his first YouTube livestream in three years.

The “Roaring Kitty” channel on YouTube – which Gill used to post the videos that helped launch the meme stock phenomenon – on Thursday showed a livestream schedule for 12 pm ET on Friday. Shares of the video game retailer surged more than 47%, rejuvenating a rally that began last month when an account associated with Gill began posting on X, formerly known as Twitter, after a years-long absence.

In 2021, Gill’s championing of GameStop, a retailer struggling with shrinking sales, helped the company’s shares rally by as much as 1,600% before they eventually tumbled. He won a cult-like following among some investors, notoriety with others.

His apparent reappearance sent GameStop shares skyrocketing in recent weeks and reignited the meme stock phenomenon. Shares of the company are up approximately 150% since May 13, when an account on X linked to Gill began posting a series of memes that some investors interpreted as indicating his bullishness on the company.

GameStop rose 21% on Monday after Gill’s Reddit account posted a screenshot showing a $116 million bet on the stock. The post, the first from the account in three years, also showed a position of 120,000 GameStop June 21 call options at a strike price of $20, worth $65.7 million at last Friday’s close.

Other names associated with the meme stock phenomenon also jumped on Thursday, with AMC Entertainment rising 12.42% and headphone maker Koss up 15.48%.

While the 2021 rally was fueled in part by individual investors banding together to punish hedge funds that had taken bearish positions in GameStop and other companies, some analysts said the same degree of fervor appears to be missing this time around.

“Despite Keith Gill’s renewed weekend appearance and ensuing GME price spike, retail traders don’t look to be sticking around too long in the trade,” analysts at Vanda Track wrote in a note earlier this week.

At the same time, Vanda believes “high-frequency institutional traders are front-running retail’s efforts, and performance data demonstrate that this is indeed not turning into a widespread bullish phenomenon for the meme stocks cohort.”

Broader market conditions do not reflect the same speculative energy as they did in 2021, said Jason Draho, Head of Asset Allocation Americas at UBS Global Wealth Management. The IPO market remains dormant, while M&A activity is mild, he noted.

“Meme stock activity isn’t anywhere near it was in 2021, even though we are seeing dramatic one-day moves,” he said.

(Reporting by David Randall; Editing by Ira Iosebashvili and David Gregorio)

Comments